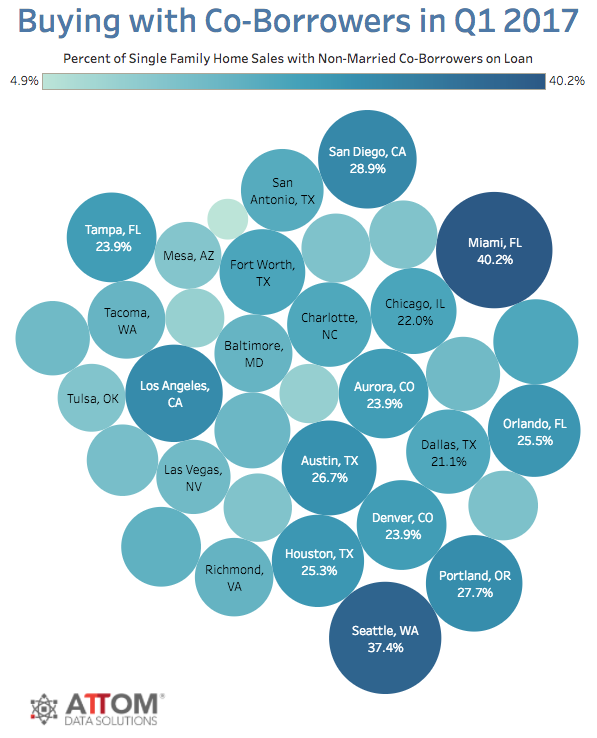

Miami has the highest share of non-married co-borrowers in the country, according to a new report from ATTOM Data Solutions.

Just over 40 percent of single-family home purchases in the first quarter of 2017 had mortgages with co-borrowers who were not married, according to the report. That’s tops for any city with at least 1,000 single-family home purchases this quarter, beating out Seattle (37 percent) and San Diego (29 percent).

Nationwide, 22 percent of all single-family purchases this quarter had multiple, non-married borrowers, up from 20 percent a year ago, ATTOM reports.

Reasons for phenomenon vary

The phenomenon is likely caused by rapidly rising home prices throughout the country. Aside from Miami, the other cities with a large share of non-married co-borrowers are on the West Coast, where prices and demand are at even higher levels.

In order to stay in the running for the relatively expensive, available homes, more people are teaming up on a home purchase, according to ATTOM.

“Increased competition amongst buyers for low available listing inventory and increasing multiple-offer scenarios are driving down use of leveraging mortgages in support of resale transactions while driving increased use of all-cash offers to gain acceptance over competing buyers,” Michael Mahon, president at First Team Real Estate, covering the Southern California market, said in ATTOM’s report.

That isn’t the only possible explanation, as the Miami Herald reports. It could be a parent signing on with a child, or business partners investing in a property.

“The first thing that comes to mind when you hear co-borrowers is two people who are living together,” says Ron Shuffield, president of EWM Realty International. “But co-borrowers could be anything from millennials buying a home with the help of their parents to investors buying a property together. A lot of home sales we do are for investment purposes or involve buyers who need co-signers, because they don’t have enough credit to qualify for a mortgage.”