The foreign presence in Miami’s real estate market has long preferred residential investments over commercial ones – evidence of a desire to make quick or protect money rather than plant long-term roots. However, as Alex Zylberglait, a real estate investment expert, noted in a recent interview with Mansion Global, that dynamic seems to be shifting.

“For decades, foreign buyers came to the U.S. to buy condos. But a strong dollar and skyrocketing condo prices has been shifting foreign investors’ appetite in Miami real estate from residential to commercial,” Zylberglait, vice president and investment adviser at Marcus & Millichap Real Estate Investment Services, said.

In 2011, Florida accounted for 31 percent of the nation’s foreign home sales, with the majority of those sales happening in the state’s southern tip. It was the highest share of foreign home sales in the nation by a margin of 19 percent. However, by 2016, that share had dropped to 22 percent, and the margin between No. 1 and No. 2 (California) fell alongside it to just 7 percentage points.

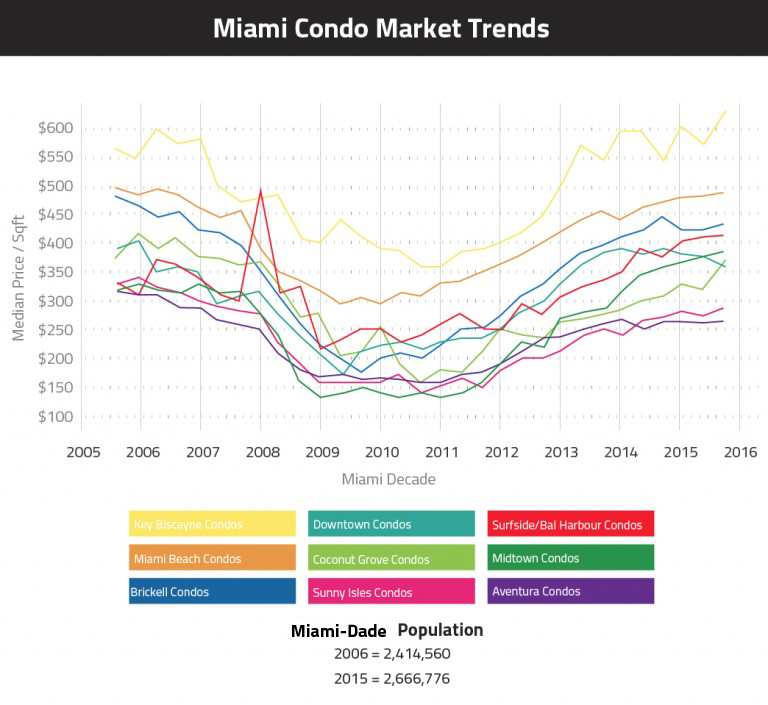

During that same five-year stretch, as our below graph illustrates, condo prices in Miami skyrocketed. In some areas, like Key Biscayne, median prices went up by upwards of $250,000.

“As the condo pricing got significantly out of balance in mid- to late-2014, we began to see a lot of foreign buyers saying, ‘I would rather own a commercial asset that’s going to give me more predictable cash flows and a higher appreciation potential,” Zylberglait said.

Between 2009 and 2014, he explained, the annual commercial real estate sales volume in Miami fluctuated wildly, going as low as $71 million and as high as $714 million. But in 2015, there was a shift, and commercial sales ballooned to more than $2 billion.

And then condo sales plummeted.

In this year’s third quarter, condo sales in Downtown dropped more than 35 percent year-over-year, with similar drops being recorded in neighborhoods throughout the region.

Prices will drop

Zylberglait said that the increase in commercial sales and drop in residential is evidence that “foreign capital isn’t really leaving Miami, but rather changing the type of asset.”

But what does that shift ultimately mean for Miami?

About half of the state’s foreign residential real estate sales took place in Greater Miami last year, with significant investment coming through Latin America and China. And while buyers from those areas are still showing interest in South Florida’s residential market, even a slight shift to commercial could put downward pressure on single-family home and condo prices – which is already happening in some areas.

The news is especially grim for the city’s condo market, where sales are currently plummeting and inventory is dramatically rising. Over the next six years, Greater Miami is expected to add nearly 22,000 new condo units to the market, despite already having more than a year’s supply of inventory.

But investors are more invested

Still, the news is not universally bad. The fact that foreign investment is remaining in Miami is good; and furthermore, the fact that it’s now being put into commercial properties suggests, as Zylberglait explained, that the investors are more serious about investing in the city than they are about turning a quick profit.

“There’s a lot more equity invested in assets this go-around than there was during the last downturn. Investors, especially foreign investors, have a longer term investment position. They’re not necessarily looking to get in and out,” he said. “Those looking to come in and score a strong profit on a quick basis are going to have a difficult time doing so. For those reasons, we’re well position to withhold a market correction.”

Zylberglait added that in 2017, Miami residents should expect to see the industrial, retail and office sectors doing well.