Hurricane Matthew tore through Florida’s east coast last Friday, and in its wake left a trail of destruction that amounts to billions in losses, according to data from CoreLogic. It’s a reminder of the importance of insurance.

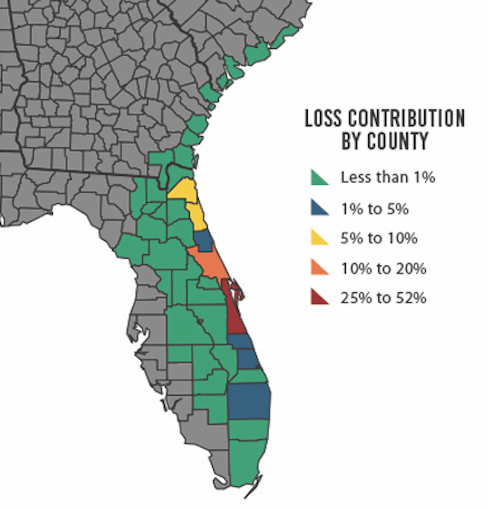

The highest estimates of total insured property losses from Matthew are in the ballpark of $6 billion; the low end is about $4 billion. Wrecked homes and flooding can be found all along Florida’s east coast and up into Georgia and South Carolina. And while Miami-Dade and Broward counties were two of the first hit by Matthew, the worst of the storm passed them by. It was Florida’s Brevard, Volusia, St. Johns and Duval counties that took the worst of it. Still, Miami residents may have taken a massive loss.

If we compare the overall damage of Matthew to previous hurricanes, such as Katrina and Sandy, as CoreLogic did, the extent of the loss seems suddenly less acute. But when you consider the number of uninsured properties in Miami, and how those figures have dropped over the last decade, the losses to residents could be significant.

| Matthew (2016) | Katrina (2005) | Sandy (2012) | Floyd (1999) | David (1979) | |

|---|---|---|---|---|---|

| Total insured property loss estimates | $4-6 billion | $35-40 billion | $15-20 billion | $3 billion | $2 billion |

In 2006, a year after Katrina, 90 percent of Greater Miami homeowners had property insurance, according to a report from Trulia. By 2014, that share had dropped to 78 percent.

Matthew hit Miami on Friday as a Category 3 hurricane. According to a CoreLogic analysis, a storm of that magnitude could have put nearly 400,000 homes at risk, which would have amounted to roughly $74 billion in reconstruction costs. If we imagine that even 20 percent of those homes are uninsured, the reconstruction cost burden to residents could have ultimately neared $15 billion (though, that number is only a very rough estimate and could be much higher or lower, depending on the distribution of damage).

But of course, Miami was lucky. It avoided the worst of Matthew. It was a close call, but still a reminder that in areas of the U.S. where hurricanes are more an inevitability than a fear, that the proper types of insurance are paramount to protecting the biggest investment most people will make in their life: their home.