By 2019, the size of Florida’s economy is projected to be nearly $1.1 trillion, according to a new projection from University of Central Florida economist Sean Snaith. Today, that would make Florida the world’s 16th largest economy, and that has big implications on the state’s real estate market – especially in Miami.

“The fundamental underpinnings of the housing market in Florida continue to strengthen. Job growth in Florida is forecasted to continue outperforming the U.S. labor market and more Baby Boomers continue to reach the end of their working lives,” wrote Snaith, defining the pillars of the state’s economy: housing and jobs.

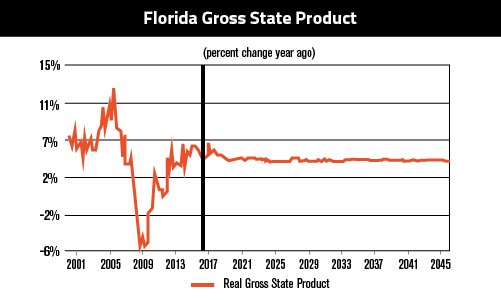

In his forecast, Snaith, an expert in economic projections, analysis and market sizing, and named by Bloomberg News as “one of the country’s most accurate forecasters,” laid out an economic scenario that sees the Sunshine State’s Real Gross State Product (RGSP) expanding at an average annual rate of 2.9 percent from 2016 to 2019 – faster than what he anticipates the national rate to be during the same period. At this pace, the state’s RGSP is expected to break $1 trillion by 2018 – and Snaith expects the state to maintain a similar growth rate until at least 2045.

But Florida’s exponential growth is no guarantee. The state’s labor market will need to continue recovering, and its housing market will need to normalize and further strengthen.

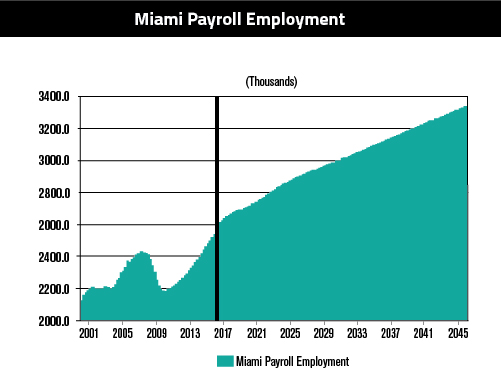

From 2016 to 2019, job growth in the state is expected – much like its RGSP – to surpass the national rate, rising at an annual average of 2 percent, with the most robust growth happening this year (3.9 percent) and next year (2.4 percent). It drops off to a little over 1 percent in 2018 and below that in 2019. Snaith said the improved rates, driven largely by strong construction-sector growth, should not only encourage more Floridians to enter the job market, but also attract workers from out of state.

However, improvements in the labor market will depend on how the state’s real estate market performs, which, according to the forecast, is currently suffering from a single-family shortage that is forcing up prices and throttling housing starts.

Nowhere in the state is this more apparent than in Miami.

Slowing home price appreciation gives way to wider healing

In May, the median sales price for an existing single-family home in Miami rose 4.6 percent year-over-year, or from $282,000 to $295,000, according to the Miami Association of Realtors. The association’s 2016 Chairman of the Board Mark Sadek pointed out in the report that even after 54 months of consecutive increases, the city’s home prices are still comparable to 2004 price levels. He failed to mention they are also currently more than $50,000 above the national median. Snaith explained the appreciation as a side effect of low inventory.

“While this looks like another housing bubble, it’s really just an old-fashioned shortage in the single-family market,” the UCF economist explained. “It is expected to correct itself as new housing starts ramp up over the next few years.”

Today, home price growth in Miami is already slowing, allowing the market and earners to catch up.

Phil Spiegelman, a principal with real estate sales and marketing group ISG World, identified the primary contributing factor to the slowing market as “the strong dollar and the economy of Latin America.” But also, new construction in the city is on the rise, and more inventory begets lower price appreciation.

Year-to-date in April, residential construction spending in Miami was $2.279 billion, a 14 percent increase of the same time period in 2015.

Snaith has confidence in Miami’s housing market’s future, and his economic forecast for the city explains why: income and employment growth.

A road from recovery to healthy growth

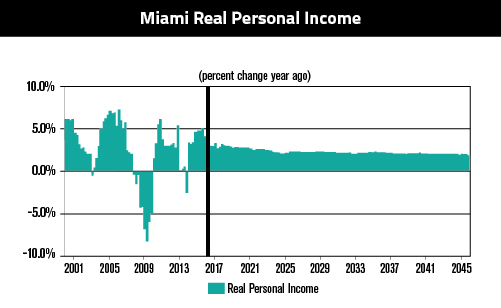

In 2000, more than half of the households in Miami-Dade, Broward and Palm Beach Counties reported earning “mid-level incomes.” But by 2014, after weathering the downturn and subsequent recession, that number dropped to 48.5 percent, according to Snaith’s report. There was a similar shift in “upper-level” earners, which fell from 15.4 percent of households to 14.8 percent. The only economic tier to expand during that period was lower-income households, which grew from 33.6 percent to 36.7 percent.

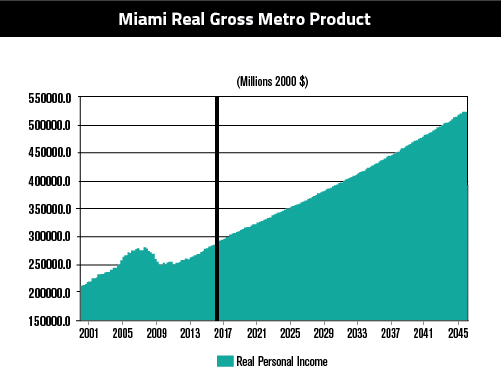

But 2014 was a stellar year for Miami. The real damage was done between 2007 and 2009, when the U.S. economy was tanking. In those two years, Miami’s Real Gross Metro Product (RGMP) fell by about $250 million; payroll employment dropped by more than 200,000; and personal incomes, at their lowest point, were declining year-over-year by 8 percent.

Since 2009, households have been in recovery. Between 2009 and 2014, which is the latest year data is available, median household income in Miami-Dade County increased by 15.7 percent, from $37,226 to $43,099. The increase precipitated growth in multiple sectors.

“When you’re making money, you’re spending more money, and more demand equals more jobs,” said Josh Navarro, a global investment specialist with J.P. Morgan Private Bank.

The momentum built over that five-year period placed Miami’s economy on an upward trajectory it is expected to maintain until at least 2045. Snaith projects an average annual personal income growth of 4.9 percent; average annual wage growth of 3.6 percent, with an average annual wage level of $58,500 (the highest of any area studied by the economist); average annual employment growth of 1.7 percent, with construction and mining being the fastest-growing sector at 3.6 percent; and an average unemployment rate of 5.2 percent, which is moderate.

If Snaith’s forecast is correct, or at least moderately accurate – which is entirely likely, considering the high praise his past forecasts have received – real estate professionals over the next 30 years can expect to face a welcoming and more stable market. Business should be good.