Criminal king pins of the world beware – Miami’s under surveillance.

In not so many words, that’s the message the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) was hoping to convey when it announced its new rules for monitoring certain all-cash real estate transactions in Miami-Dade County and Manhattan.

“We are seeking to understand the risk that corrupt foreign officials, or transnational criminals, may be using premium U.S. real estate to secretly invest millions in dirty money,” said FinCEN Director Jennifer Shasky Calvery.

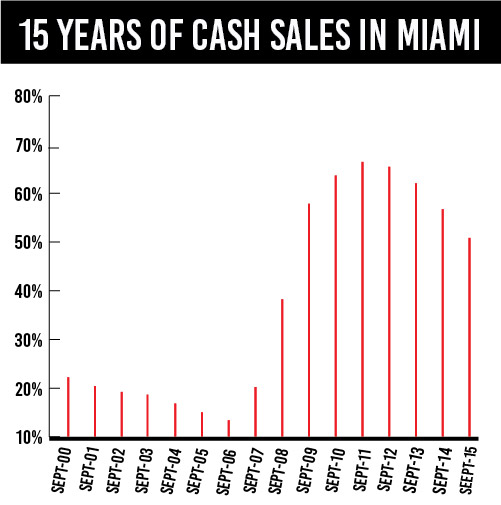

Prior to the financial crisis, cash sales in Miami regularly accounted for about 22 percent of total residential real estate transaction, according to data from CoreLogic. But after the downturn, investors – particularly from overseas – saw the market’s opportunity, and the cash sales came pouring in.

Jan. 2008 was the first month that the cash sales share in Miami reached 25 percent of total transactions, and it marked a serious turning point in the city’s market. In the 12 months that followed, Miami’s share of cash sales more than doubled to above 50 percent, and it has stayed at that level for more than 75 consecutive months.