Miami’s foreclosure market has improved markedly in the last year, according to RealtyTrac

In the first half of 2015, foreclosure activity in the Miami metropolitan area fell 30 percent from the same time period last year, according to RealtyTrac’s Mid-Year 2015 U.S. Foreclosure Market Report.

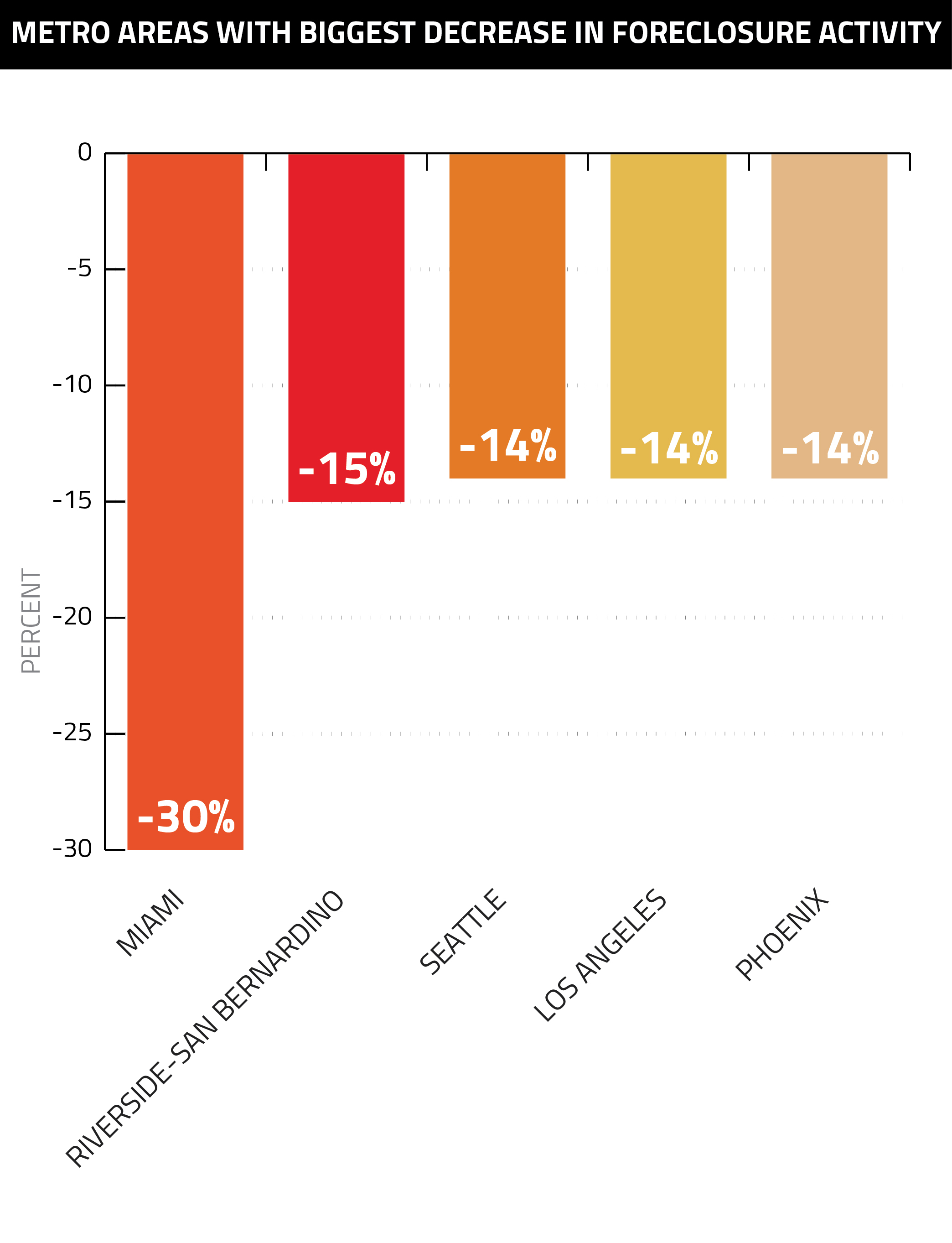

That’s the largest decrease among the U.S.’ 20 largest metro areas, and is far ahead of the national decline of 4 percent.

Below is how Miami’s foreclosure market compares with other prominent metro areas:

Foreclosures Fall to Pre-Crisis Levels

Daren Blomquist, the vice president at RealtyTrac, said that overall foreclosure activity has now returned to pre-crisis levels.

“U.S. foreclosure starts have not only returned to pre-housing crisis levels, they have fallen well below those pre-crisis levels and are still searching for a floor,” Blomquist said. “Loans originated in the last five years continue to perform better than historic norms, with tighter lending standards and more cautious borrower behavior acting as important guardrails for the real estate boom of the past three years.”

Notable Florida stats from RealtyTrac’s report included:

•Of the 10 cities with the highest foreclosure rates in the country, eight are located in Florida, including: Tampa at No. 2 (1.22 percent of housing units with a foreclosure filing); Lakeland at No. 3 (1.21 percent); Jacksonville at No. 4 (1.2 percent); Ocala at No. 5 (1.18 percent); Miami at No. 6 (1.15 percent); Orlando at No. 8 (1.07 percent); Deltona-Daytona-Beach-Ormond Beach at No. 9 (1.05 percent); and Crestview-Fort Walton Beach-Destin at No. 10 (0.97 percent).

•Florida’s statewide foreclosure activity fell 22 percent in 2015’s first half. However, with 95,129 foreclosure filings so far this year, Florida still has the highest foreclosure rate in the country; by contrast, no. 2 New Jersey saw 32,713 filings.

•Foreclosure timelines in Florida also remain high at 989 days, far above the national average of 629 days.